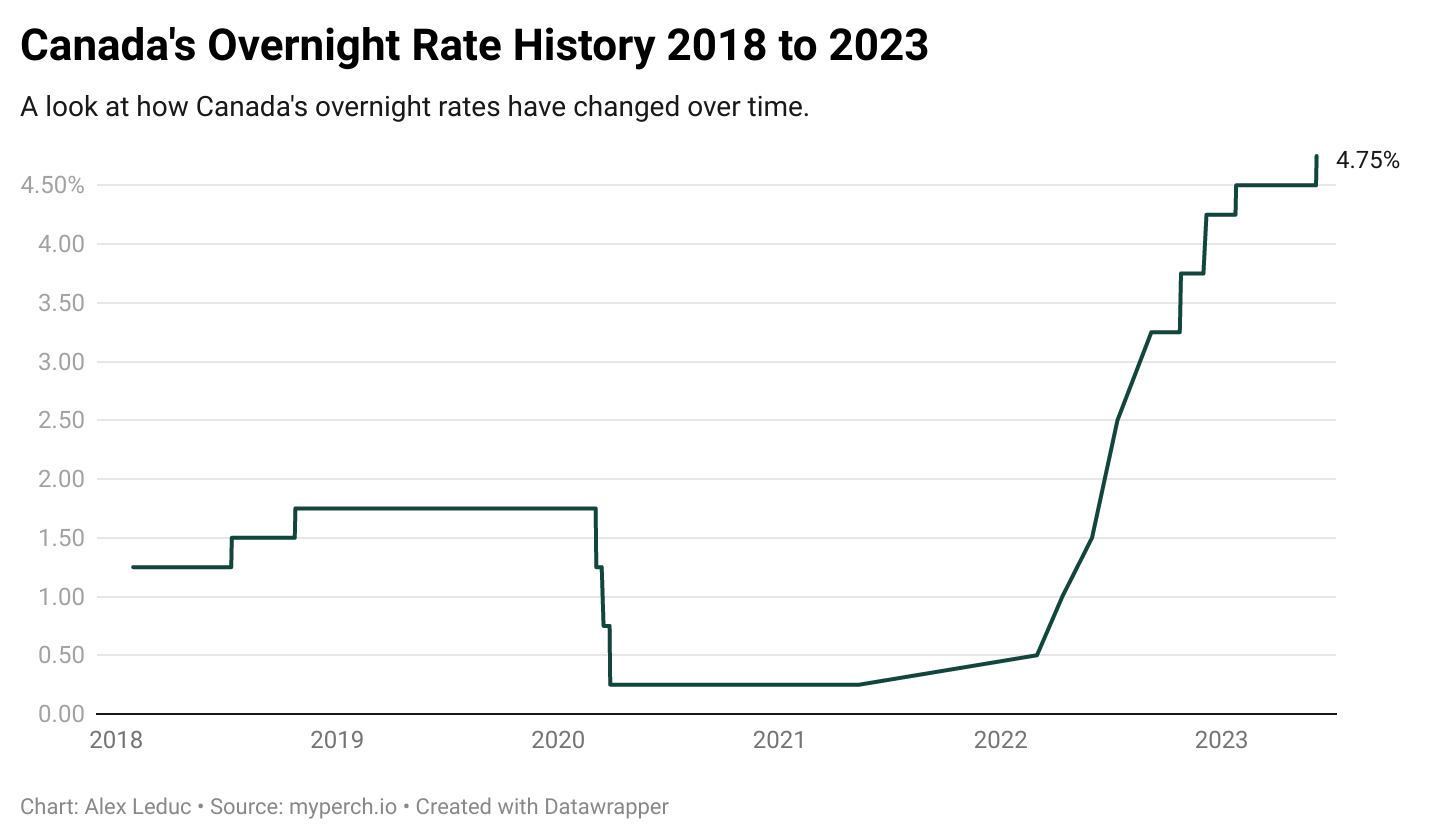

In recent times, Canada has witnessed a notable shift in its interest rate environment, with the Bank of Canada gradually increasing rates. This upward trajectory has led to speculation about the potential effects on various sectors, including the real estate market. In this article, we will explore the impact of rising interest rates on the real estate market in St. John's, Newfoundland, and shed light on the changes that prospective homebuyers and property investors may anticipate.

Impact on Mortgage Affordability: One of the significant consequences of rising interest rates is the effect on mortgage affordability. As interest rates rise, borrowing costs for homebuyers also increase. This can lead to higher monthly mortgage payments, potentially reducing the purchasing power of buyers. Consequently, some prospective buyers may find themselves reconsidering their budget or delaying their home purchase, which could slow down the real estate market activity in St. John's.

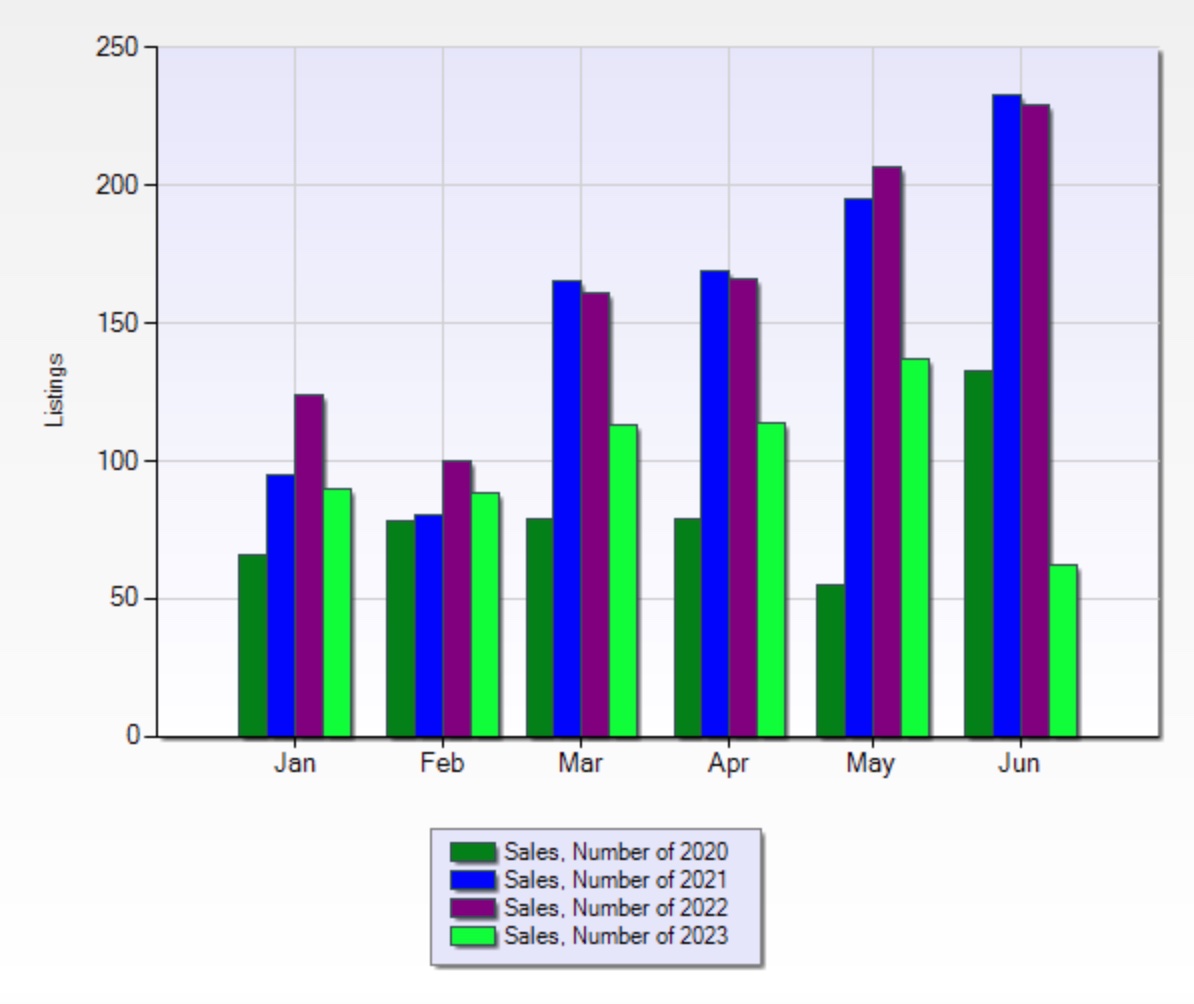

Demand and Inventory Levels: Rising interest rates can influence demand dynamics in the real estate market. When rates increase, it often leads to a decrease in the number of potential homebuyers, especially among first-time buyers or those with tight budgets. As a result, the demand for properties may cool down, leading to a potential decline in sales volume.

Historical YTD Sales in St. John’s

Excluding June, which has just begun, sales YTD are down approximately 30% from records in 2022 and 2021, and only slightly elevated from pre-pandemic levels.

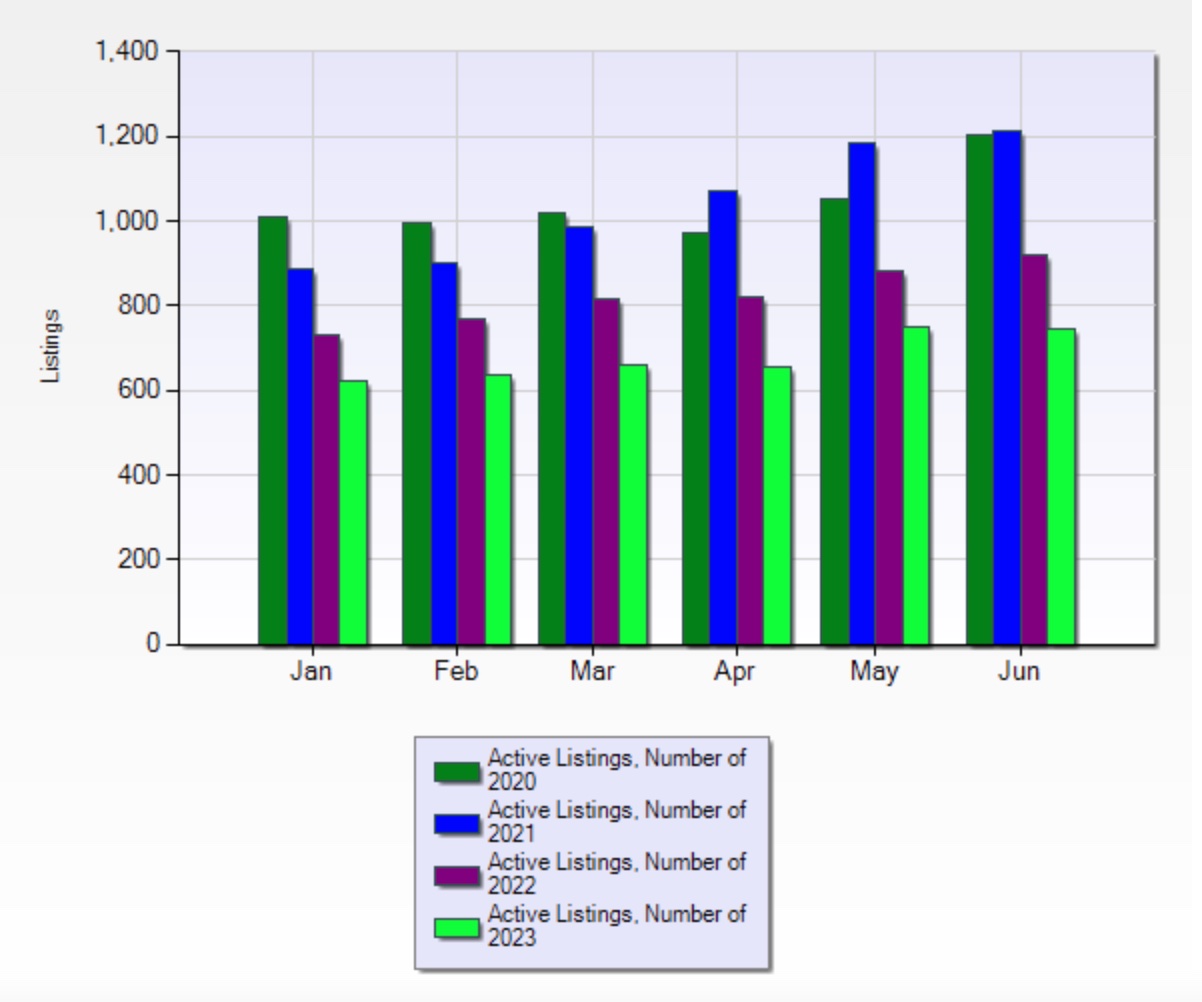

Additionally, rising interest rates affect the supply side of the market. Homeowners who have adjustable-rate mortgages or are in need of refinancing may experience higher borrowing costs, potentially discouraging them from listing their properties for sale. This reduced supply, coupled with decreased demand, creates a market with potential for significant downward adjustment on average pricing.

Historical YTD Supply in St. John’s

Again excluding June, supply is down significantly in the current market.

Impact on Property Investors: The real estate investment landscape in St. John's may also be influenced by rising interest rates. Investors who rely on financing to acquire properties may face higher borrowing costs, impacting their return on investment calculations. As a result, some investors may become more cautious or seek alternative investment opportunities. However, it's important to note that the impact on investors can vary depending on their specific strategies, financial situations and their location. In St. John’s, we have seen notable activity from out of province investors taking advantage of the cheaper prices here compared to other major cities across Canada for income properties that generate comparable rental rates, and thus better return on investment.

As Canada experiences a rising interest rate environment, the real estate market in St. John's, Newfoundland, will certainly change in response. The current market can be summarized as favouring sellers - anyone with a home to sell in a good neighbourhood and in reasonable condition can expect to have strong interest as demand remains above pre-pandemic levels, albeit cooling from the ultra hot years of 2021 and 2022. The lack of supply has supported elevated average price statistics, and multiple offer sales after short listing periods is not an uncommon occurrence.

Prospective homebuyers and property investors should be prepared for potential shifts in mortgage affordability, changes in demand and inventory levels, and adjustments to investment strategies. Monitoring the local market conditions and seeking professional advice can help navigate these changes and make informed decisions in response to the evolving interest rate environment.